SAMPLE: Research: Strategy and Trading Levels [07-11 December]

Weekly Take

Equities: Although continuing to trade close it's all-time highs, the latter half of last week was somewhat choppy with the price action on the major indices reflective of minor indecision following the solid advance during the prior week. This could be seen by reviewing the daily charts of the S&P 500 and Nasdaq where the candle structure reflected cautious optimism among market participants. For the week, the All Country World Equity Index edged higher by +1.44%, taking it's year-to-date gain to +12%. Over the 5-day period, it was Colombia that led the America's while Greece outperformed in Europe and the UAE in the Middle East/Africa while South Korea and Taiwan gained with advances of 8.5% and 4.6% respectively in USD terms. Locally, the All Share Index performed strongly, adding 2.85% for the five-day period with the relative sector performance versus the broader market as follows:

Morning Snapshot (Mid-Session Asia 06:10am)

US Sector Performance

Commodities: Despite OPEC and it's allies agreeing to increase output by 500,000 barrels a day in January, Brent Crude Oil advanced to levels last seen in March 2020, testing $49.04 by Friday's close. This gave energy sectors a boost which again outperformed the broader market by adding 5.5% on Friday. Having an even better week was Platinum which rallied by 10.2%, breaching the closely watched $1000 level during mid-week. The Rand/Platinum Price testing a 3 1/2 month high of R16451 only to pare some of those gains in late Friday trade. Did anyone see how Platinum shares came off slightly on Friday, accelerating it's downward move throughout the day. You only have to zoom out on J153 to see how range-bound the sector has been since July however we are trading close to the top of the range and a break above should open a fresh short term bull leg. I also think it's worth paying attention to the Platinum Palladium Ratio which which is breaking it's downward trend line going to May 2016. Lagging in the commodities space was Natural Gas which was down 10% for the week.

Currencies: As a reflection of risk taking and the expected stimulus, the US Dollar closed the week at it's lowest level since April 2018. This has driven dollar crosses to their best levels in months: Euro +1.21, GBP +1.35, CAD -1.28, AUD +0.7450, JPY -103.20, ZAR -15.10 BRL -5.11, CNY -6.52, INR -72.76. In Friday, the British Pound showed volatility at the highs as continued uncertainty swirled around Brexit negotiations.

Bonds: US treasuries continued to sell off with the US 10-Year Bond Yield testing a high of 0.9842%, then closing at 0.9675%. Anyone else out there wondering how long until the headlines say: "Equities softer on the back of higher interest rates"? We also see the US 10-2 Yield continuing to widen with it being the biggest spread since February 2018, reflective of the 'reflation trade'. German 10Ys closing at -0.54% while the South African 10Y closed at 8.98%.

Front of Mind: 8 Themes - Checking In

To better view this text, 'open image in new tab'

US 10 Year Yields Spread vs Nasdaq Composite: Produced in two separate charts, you will note there is a correlation between the spread's acceleration sharp declines in the Nasdaq. The date (start) refers to the start of the spread's acceleration.

Nasdaq Composite: Bold risk-taking at present, but please note the index is 25% above it's 200-day simple moving average, the second highest since March 2000.

SPY...optimism is high...at least buy some protection here...?

Stocks vs GDP - Risk assets are at their highest levels vs GDP and twice the mean going back to 1972.

Interesting chart as well from GS showing short interest in the S&P 500: Investors, too certain about that 'Powell Put'?

JSE Top 40 - Skyscraper View | The monthly chart paints a clearer picture of the setup for SA large caps, and while it is early in the month to suggest that we see close at current levels, we note the last close sitting at the upper boundary of it's 3-year resistance range. It should also be noted that the index has steadily held it's pivot while trading just over 1000 points below 'resistance level 1'. Are we overbought? In the short term we're probably close to it however the monthly RSI suggests a 'strong but not overbought' reading.

DAX - Pending Breakout - Trading Below Multi-Year Supply | We continue to take a positive view on German equities as the technical outlook suggests a market forcefully trading below multi-year supply of 13500-13600 and where a break and close above this zone would mean a continuation of the upward channel in place since February 2003. Long term target: 16000-17000.

Latam Lifting? - Latin America 40 vs S&P 500 | On a relative basis, we may be on the verge of a multi-year reversal where Latin American equities may potentially start to outperform US equities. This is evident as we review the monthly chart of ILF ETF vs SPY ETF and note the following: (1) a false breakdown with a sharp two-month reversal to regain multi-year swing support. (2) sharp back-test of breakdown level. (3) 14-period RSI back above the 50 level. (4) multi-year bullish divergence on the MACD and RSI. I'm happy to have a look at some single stock opportunities in the region.

Anheuser-Busch Inbev (ANH) | The share has consolidated for just over 3 weeks with the structure having developed a rectangle pattern where the price closed above the resistance. The technical indicators suggest strength however from a short term trading perspective we would like to see the price remain above R1070 as evidence that a trend continuation is at hand. Note the price above a rising 20-day EMA (positive development).

MTN Group (MTN) | The price has developed a cup and handle technical pattern however ultra short term supply remains in the range of 7075-7115c range. For traders, we want to see this zone being held as a trigger which would open up 7312c as a first target while maintaining 6710c as a stop-loss up the aforementioned being triggered.

Truworths (TRU, 3741c) | The stock has some work to do as it possibly develops a bull flag formation. To trigger this setup we would need to see: (1) clear and hold the prior 5-day range i.e. hold with strong bids above 3855c (2) hold above the pivot (P). Following a break away from it's 50-Day EMA, we have seen the price re-test this EMA with a strong 1-day bounce on Tuesday. My provisional levels are: Buy on a close above 3860c or above the channe. Stop-loss: 3570c. Targets: 4060c, 42.00.

Discovery Holdings (DSY, 12545c) | We are monitoring the price action on the name, having noticed the development of a short term consolidation channel possibly in the form of a bull flag. We are seeing the price bounce off the pivot although Friday's candle reflected some selling from intraday highs.

Dis-Chem Pharmacies (DCP, 2127c) | The name continues to be a 'steady grinder' from our last buy call at 1715c, +24% (30 July). At current levels, the share is in the latter stages of developing a bull flag technical formation while also attempting to break to the upside the base in place since 12 May 2020. The bull flag is around 55-60% complete which means we would see come consolidation in coming sessions however traders should monitor for a breach of the bull channel as a trigger that the next leg is about to commence. Also note the price attempting to find support on the second tier of the aforementioned multi-month base.

Mediclinic International (MEI) | The name has under-performed since it's recent peak on 12 October however my ultra short term view is that it could be oversold and attempting to find a base as evidenced by the slowdown in downward momentum while the lower wicks from 25 November onward suggest some (small) buying activity. I don't know if this is the exact short term bottom however here's a potential scenario: the price opens lower then regains Friday's low to develop a reversal candle. I'll be watching it closely so no buying levels as yet.

JSE Gold Index: We continue to follow a robust technical process which helps us to not predict but manage risk. Long time readers of our research will know that we expresses some concern over the level of JSE gold shares back in July 2020 following a multi-month, +640% surge off the August 2018 lows. While our timing was not 100% perfect, as the sector peaked only a few weeks later in August 2020. We have since seen the sector decline by close to 49% with the following being noted: (1) price approaching and close to it's prior multi-year supply and April 2020 breakout level. Here we would look for support (combined with strong candle structure) as breakout levels are often re-tested.

JSE Gold Index vs JSE All Share Index: On a relative basis, we also saw the sector +450% off it's August 2018 lows versus the All Share Index, with a double bottom technical formation having developed on a multi-year basis.

Patterns Pay: A large part of uncovering technical trading opportunities involve focusing on repeatable, high probability patterns. We have recently started to see the beaten down property sector with strong buying activity however if your time frame is ultra short term, then you'd may want to start lightening up. For example Hyprop is a share at 1668c constructed a similar setup to a stock in a different sector: Motus, where a descending triangle pattern broke to the upside and subsequently rallied close to 100% over a 2-month period. At current levels, HYP is +90% from our flag to it's last close of 3152c. If you need assistance in uncovering 'pattern plays', chat to Research, the Dealing Desk or a PM today. For more on using technical patterns/formations in your trading and investment decision-making, please see our article 'Turning Patterns To Profits (19-August)' https://www.sharenet.co.za/views/views-article.php?views-article=477297

Commodities: Iron Ore (Update) | Continues toward multi-year channel highs. Monthly RSI's remain very strong and nearing overbought territory.

Resources Stock Update: In the 23 November report we placed particular emphasis on commodities and related names, suggesting that we could see out-performance on an absolute and relative basis. The group has performed strongly over the ultra short term with: AGL +16.6%, BHP +16.8% (originally flagged at the R304 gap, GLN +23.2%, KIO +15.8%, S32 +15.8%. According to our technical sentiment data extract, these names are now nearing ultra short term overbought territory however remains strong on the higher time frames. While the risk-to-reward on the buy/long side was attractive 2 weeks ago, it is less so with prices at current levels.

Offshore: Using both manual and automated scanning processes, we picked up a number of names with attractive setups.

Arconic (ARNC, $30.90) | Market Cap: $3.37bn | The company is engaged in manufacturing aluminum sheet, plate, extrusions and architectural products and was spun out of Alcoa in October-2016. On The Chart: We recognize the potential for a breakout of the IPO highs - a level that has been tested since February 2017. Here, a close above $31.70 suggests the absorption of long term overhead supply. On The Chart: Targets of 42.00 and 47.15 open up over the long term. Stop: $26.29.

Cleveland Cliffs (CLF, $12.55) | Market Cap: $5.01bn | formerly Cliffs Natural Resources Inc., is a mining and natural resources company. The Company is a supplier of iron ore pellets to the North American steel industry from its mines and pellet plants located in Michigan and Minnesota. The Company operates through its U.S. Iron Ore. The Company is a producer of iron ore pellets, primarily selling production from U.S. Iron Ore to integrated steel companies in the United States, Canada and Mexico. In the United States, the Company owned four operational iron ore mines and one indefinitely idled mine. On The Chart: The share is looking to break to the upside of a 6-year consolidation zone. pending break of 6-year base where a close above $13.90 triggers a buy for long term momentum traders. The monthly chart technical indicators also suggest strength, with the MACD attempting to regain the zero bound while the 7 and 14-period RSI's are in a bull regime. Stop-loss (upon trigger): $11.40. All time high of 121.95 in June 2008.

iShares Trust Broker Dealer and Securities Exchanges ETF (IAI, $76.04) | The ETF has our preferred bank Morgan Stanley as the biggest weight. On The Chart: The price is making all-time highs but has only recently broken to the upside of a two and half year consolidation range. The technical indicators suggest strength, but not long term overbought.

Raymond James Financial (RJF, $95.83) | Market Cap: $13.12bn - is a financial holding company.It operates through five segments: Private Client Group (PCG), Capital Markets, Asset Management, RJ Bank and the Other segment. The Private Client Group segment includes the retail branches of the Company's broker-dealer subsidiaries located throughout the United States, Canada and the United Kingdom. The Capital Markets segment includes institutional sales and trading in the United States, Canada and Europe. The Asset Management segment includes the operations of Eagle, the Eagle Family of Funds and other fee-based asset management programs. RJ Bank segment provides corporate loan, securities based loans (SB) and residential loans. On The Chart: Could resume it's bull leg above $100.

Casa Systems - 5G technology solutions for ultra broadband. Provides a software-centric infrastructure solutions. In addition, the Company offers solutions for next-generation distributed and virtualized architectures in cable operator, fixed telecom and wireless networks. Its products include axyom software platform, delivery platforms, multi-service applications, capacity expansion products. After being trading in a downward trend from it's post-IPO peak of $34.12 in March 2018, the stock broke out of a 12-month base while the monthly chart technical indicators suggest the commencement of a strong trend. While the share could possibly se a short term pullback, the long term outlook has shifted from Neutral to Positive. Accumulate on a pullback below $6.25, using a stop-loss of $5.15. Targets: $8.60-$9.70.

AT&T (T, $29.54), we point this name out a two weeks ago, however we think it's worth emphasizing. The base consolidation appears to be resolving while the minor downward trend line is being breached. Note the MACD having regained the zero bound while the 7 and 14 period RSI's are in a bullish regime. Not a fast mover however the short term trend is higher on this name. Stop: $28.47. Targets: 32.09 (gap close), $33.30.

Energy Fuels Inc (UUUU, $2.58) - is engaged in conventional and in situ (ISR) uranium extraction and recovery, along with the exploration, permitting and evaluation of uranium properties in the United States. The Company operates through two segments: ISR Uranium and Conventional Uranium. It conducts its ISR activities through its Nichols Ranch Project, located in northeast Wyoming. On the chart: We note the price breaching it's 9-year downward trend with a potential double bottom that triggers an 'add' above $3.50.

Tower Semiconductor (TSEM) | The monthly chart of TSEM has caught attention with the price nearing the upper boundary of a 15-year base. It should also be noted that the price has crossed above it's 3-year downward trend line.

Twitter (TWTR, $47.73) | Despite recently having reported results that were slightly below the market's expectations, the share continues to show technical resilience as it trades near the upper end of a 5-year range which we identify as a rounding base or more specifically a cup and handle technical pattern. Our initial positive view was triggered at $39.26 (23-Aug-2020) by the break of the share's downward trend line and post-IPO peak which occurred in December 2013. This break was key as it signaled a change in long term trend as well as the possible ceasing of multi-year overhead supply. Investors and traders want to stay long above $44.80, using a stop-loss of $40.71. Upside target over the medium to long term are $53.00 and $56.42.

Chewy Inc | Two areas that have long term structural growth opportunities: Pets and e-Commerce. With lock-down orders being instituted across the US, we could continue to see this name accelerate it's upward move into the Q1 2021. Since September, the share has developed a cup and handle technical formation that has broken to the upside and is re-testing it's breakout level. I'll be looking for $72.41 to become support (previously resistance), following which we could see 85.08 and 92.58 as medium term targets.

Relative Sector Analysis | We review the relative chart of two of the strongest sectors in the market: Semiconductors (SOXX) and Expanded Software (IGV) where we note that SOXX is beginning to break to the upside of a 12-year rounding base formation which carries a high probability. Here, the chart suggests that Semiconductors have the potential to outperform Expanded Software on a relative basis.

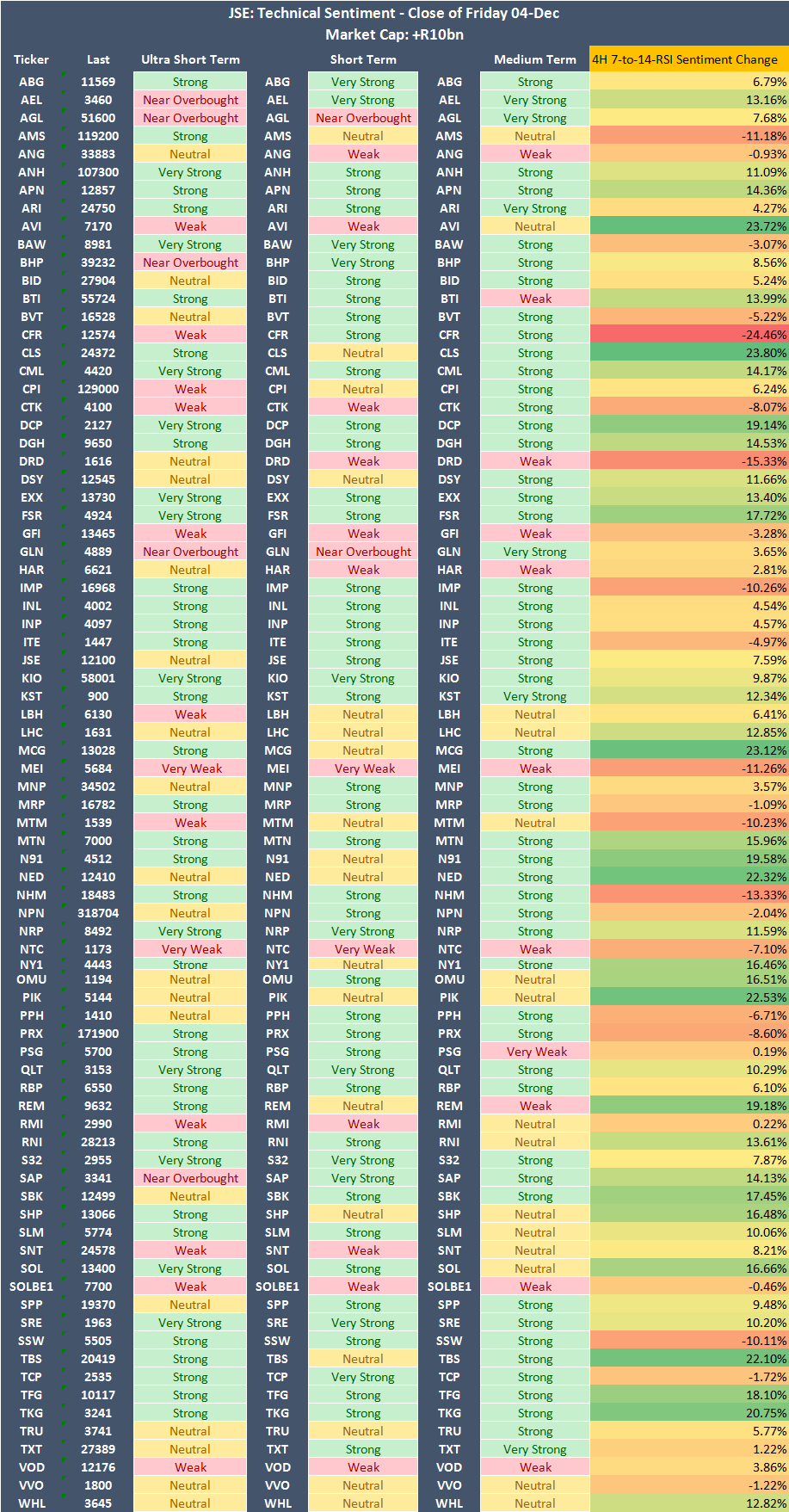

Technical Sentiment Guide: JSE Large Caps

Time Frames: Ultra Short Term/Short Term/Medium

Technical Sentiment Guide: JSE Market Cap R2bn to R10bn

Time Frames: Short Term/Medium Term/Long Term

Technical Sentiment Guide: US Large Caps

Time Frames: Ultra Short Term/Short Term/Medium

The Last 48 - Notable Newsflow

Tens of millions in California under stay-at-home order starting Sunday night | Southern California and San Joaquin Valley residents will be under a stay-at-home order after the intensive care unit capacity in the two regions fell below 15%, triggering a mandate issued by the governor earlier this week that aims to bring down the soaring number of Covid-19 hospitalizations. The order goes into effect Sunday at 11:59 p.m. PT for the some 27 million people in the regions, which includes Los Angeles and San Diego. That follows a proactive order issued by six San Francisco Bay Area jurisdictions on Friday for its almost 6 million residents. It also goes into effect Sunday. (CNN)

Moderna Expects to Produce Up to 145 Million Vaccine Doses by April | Moderna disclosed new details about the expected supply of its Covid-19 vaccine, indicating it could provide enough by the end of March to immunize as many as 60 million people in the U.S. and 12.5 million outside the U.S. (DowJones/Morningstar)

Glencore CEO Glasenberg to Retire After 18 Years at the Helm | Ivan Glasenberg, the longtime chief executive of Glencore, is handing over the reins of the global mining and trading giant he built, saying he would retire in the first half of next year. (DowJones/Morningstar)

Kudlow Calls for Extension of Enhanced U.S. Jobless Benefits | President Trump's top economic adviser said that he sees Congress making progress toward a new stimulus deal and urged legislators to act quickly, as a report from the Labor Department showed a slowdown in the pace of hiring. (DowJones/Morningstar)

Here's a head-scratcher: The use of cash has been declining for years in Britain, but demand for banknotes is skyrocketing. Nobody is quite sure where the money is going. A group of UK lawmakers said on Friday as much as £50 billion ($67.4 billion) in cash was "missing," and it urged the Bank of England to investigate. The money is "stashed somewhere but the Bank of England doesn't know where, who by or what for — and doesn't seem very curious," Meg Hillier, chair of the House of Commons Public Accounts Committee (PAC), which oversees government finances, said in a statement. "It needs to be more concerned about where the missing £50 billion is," she added. (CNN)

Southwest Airlines warned 6,800 employees of impending layoffs. They would be the first in the carrier's nearly 50-year history. (CNN)

Saudi Arabia, Russia and other oil producing countries have agreed to start tentatively increasing output next month even as the coronavirus pandemic continues to cloud the outlook for demand. (CNN)

Warner Bros., the world's second-largest movie studio, may have just upended the way the world watches movies. The studio announced Thursday that it would stream its entire slate of 2021 movies on its HBO Max streaming service at the same time they hit theaters— a drastic leap that none of its competitors have yet taken, and one that deals another blow to struggling movie theater operators. The news sent shares of AMC and Cinemark plunging more than 15%. "No one wants films back on the big screen more than we do," said Ann Sarnoff, CEO of WarnerMedia Studios and Networks Group. "We know new content is the lifeblood of theatrical exhibition, but we have to balance this with the reality that most theaters in the US will likely operate at reduced capacity throughout 2021." (CNN)

A Chinese startup just rolled out fully driverless robotaxis on public roads in Shenzhen. Unlike previous pilot programs with autonomous shuttles, these robotaxis have no backup safety driver inside or any oversight from a remote center that could intervene if needed. If that's not scary enough, the cars can also go virtually anywhere in the city — a sprawling metropolis of more than 12 million people. The Alibaba-backed company, AutoX, released a video of its minivan navigating on its own through the city, with people and even a dog hopping in. The car moves around loading trucks, veers past pedestrians, and performs a U-turn, writes CNN Business' Michelle Toh.

The Week Ahead: (via: TradingEconomics)

The coronavirus situation around the globe will continue to dominate the headlines, as well as negotiations on a post-Brexit trade deal. Elsewhere, monetary policy meetings in the Eurozone, Brazil and Canada will be keenly watched, as well as updated GDP figures for Japan, the Eurozone, the UK, Russia and South Africa. Other important releases include US and China inflation data; US and Australia consumer sentiment; UK and China foreign trade; Germany and India industrial output; and Japan current account and machinery orders.

In the US, the consumer price report for November will probably show inflation rate falling further from September's six-month high and remaining well below the Federal Reserve's target of 2 percent amid subdued demand due to the coronavirus crisis. At the same time, the preliminary estimate of Michigan consumer sentiment for December will likely show a slight deterioration in morale amid rising COVID-19 cases and new restrictive measures across the country. Other notable publications include producer prices, JOLTs job openings, the government's monthly budget statement, and the final readings of wholesale inventories and third-quarter nonfarm productivity.

Elsewhere in America, central banks in Canada and Brazil will probably leave interest rates at record-low levels when they meet on Wednesday. Important data to follow include Canada Ivey PMI; Mexico inflation rate and industrial output, and Brazil retail trade and consumer prices.

Overseas, the EU and UK continue post-Brexit trade negotiations with officials from both sides sending mixed signals about the progress in talks. Negotiators have been stuck on differences over fisheries, state aid for companies and rules to resolve disputes. Meanwhile, the ONS will be publishing monthly GDP figures, alongside industrial production, construction output and trade balance, and Halifax will be releasing its house price index.

Elsewhere in Europe, the ECB will deliver its latest monetary policy decision, with investors expecting an extension to the pandemic bond-buying program by six months and an expansion of the size of the stimulus package. An extension by nine or twelve months or a bigger increase in the size of the bond program would be supportive for markets. On the economic calendar, investors will keep an eye on the Eurozone final estimate of third-quarter GDP and employment; Germany industrial output, foreign trade and investor morale; France, Spain and Italy industrial output numbers; the Netherlands, Sweden and Ireland inflation rates; Russia final third-quarter GDP data; and Switzerland and Turkey unemployment rates.

In Asia, China will be publishing consumer and producer prices for November, with markets pointing to a slowdown in inflation rate to the lowest since 2009 while producer deflation will probably ease slightly. In addition, trade figures will provide an insight of the post-pandemic economic recovery, with exports and imports seen rising sharply in November.

Elsewhere, Japan's key data include the final reading of third-quarter GDP, current account, machinery orders, household spending, producer prices, Reuters Tankan index, and Eco Watchers Survey. Investors in Australia will turn their attention to NAB business confidence, Westpac consumer confidence, Ai Group Services Index, and third-quarter house prices.

Other highlights include: India industrial production; South Africa third-quarter GDP figures and inflation rate; New Zealand Business NZ PMI.

Comments

Post a Comment